The Gambia Energy Deficit in 2024

Currently, every country is concerned about energy. From production and sourcing to distribution and availability, energy is crucial for economic development. Investment, innovation, and living standards heavily depend on it. The Gambia, in particular, struggles with low energy access, heavily relying on fuel imports from neighboring countries. This dependency makes its economy vulnerable to external shocks from oil price fluctuations and foreign exchange volatility.

The National Water and Electricity Company (NAWEC) supplies about 50% of The Gambia’s electricity. The other 50% comes from two Independent Power Producers (IPPs) and a regional cross-border interconnection with Senegal. NAWEC operates two main Heavy Fuel Oil (HFO) plants and seven small diesel provincial plants. However, inadequate maintenance and limited investment have resulted in chronic excess demand, causing frequent blackouts and power outages. With an urbanization rate of approximately 63%, coupled with demographic and economic growth, the demand for electricity in The Gambia is expected to rise significantly in the coming years (Energy Charter, 2021).

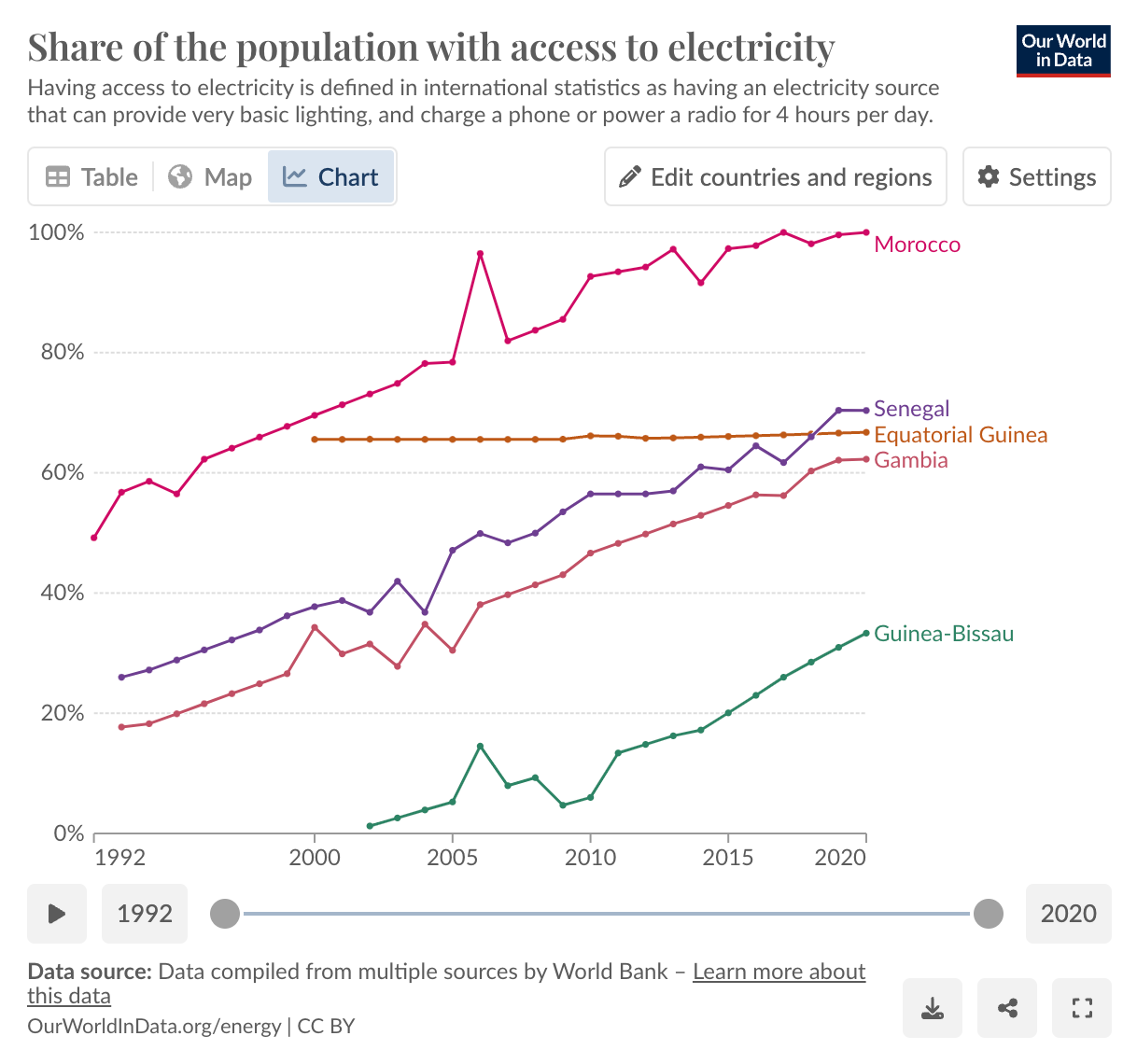

The Gambia’s per capita electricity consumption is around 136 kilowatt-hours, which is among the lowest in the world (for comparison, Norway consumes 28,095 Kwh and India 1,297 Kwh). As of 2020, electricity access in The Gambia is below 65%, higher than Guinea-Bissau but lower than Senegal, Equatorial Guinea, and Morocco (Ritchie, H., & Rosado, P., 2024).

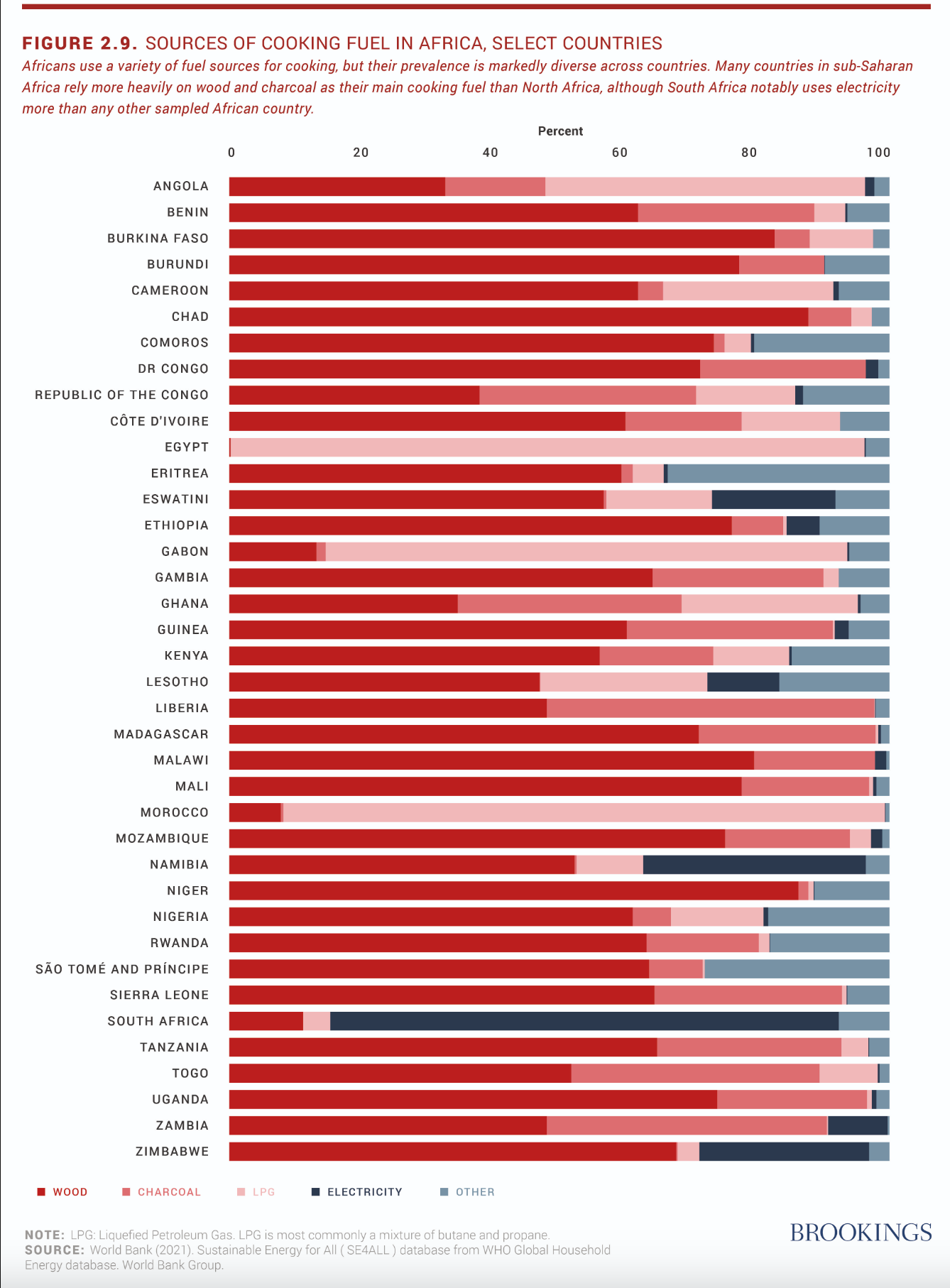

The need for cleaner energies is more urgent than ever before. Gambian households make up 44% of the country’s electricity demand. Around 90% of those households use wood and charcoal as sources for cooking fuel. Not only does this pose economic costs on the country, but it is also detrimental to the health of its population. Firstly, “air pollution caused by environmentally hazardous wood and coal cooking technologies result in respiratory illnesses, natal complications, heart disease, and premature deaths of children” (Gilpin, R., 2022). Secondly, African women spend on average 20 hours per week collecting firewood and up to 4-5 hours per week cooking on traditional stoves. If cleaner technologies were to be incorporated thanks to higher electricity access, they would have more time for other activities. Lastly, biomass fuel causes deforestation of up two 2 million hectares per year (twice the size of The Gambia).

The graph below illustrates the sources of cooking fuel across African countries in 2021. It reveals that a significant portion of West Africa continues to rely heavily on traditional biomass fuels, such as wood and charcoal. In contrast, only a small percentage of people in these regions use Liquefied Petroleum Gas (LPG) and electricity. South Africa stands out as the only African country primarily utilizing electricity as its main cooking fuel, with Zimbabwe and Namibia following suit. In the meantime, nations abundant in LPG, such as Egypt, Gabon, and Morocco, primarily rely on it for their cooking needs.

Note: LPG is a portable, clean, and efficient energy source, primarily derived from natural gas and oil production, with a growing share coming from renewable sources.

Prioritizing electricity transmission is vital for The Gambia. Even if the country boosts clean energy production, without modernizing and enhancing its transmission lines, there will be no significant impact on the living conditions of its people (US Embassies, n.d.). Transmission lines are essential for efficiently distributing electricity from generation sites to end-users. Without a reliable transmission network, even the most advanced and sustainable energy production systems become ineffective.

Given its limited resources, The Gambia relies heavily on contracts with Independent Power Producers (IPPs). These independent entities generate electricity and sell it to government-owned utility companies or directly to the government. IPPs recover their costs through electricity sales and fill the market gap when the government cannot provide public goods due to financial constraints or lack of technical expertise. However, IPPs face several risks:

- Currency risk: IPPs incur costs in US dollars for inputs like fuel and capital, but their revenues may be in local currency.

- Political risk: Government changes or policy shifts can negatively impact contractual terms.

- Technology risk: New technologies and investments might not perform as expected, failing to meet contractual obligations.

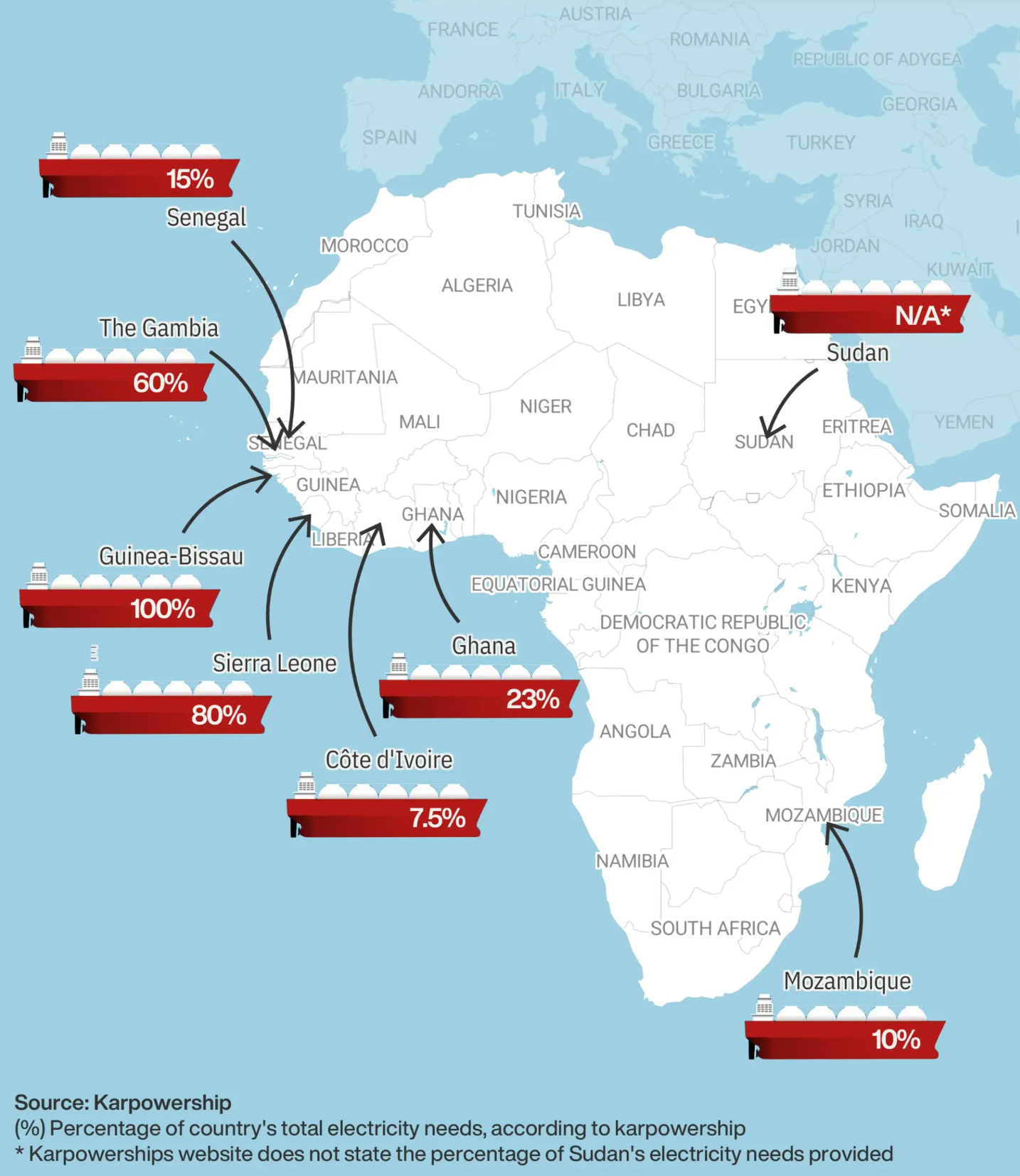

In February 2018, after leader Yahya Jammeh stepped down, a contract was signed between Karpowership and NAWEC to deploy a powership delivering around 36 MW. It reportedly supplied 60% of The Gambia’s total electricity needs, though this claim is debatable.

The procurement process for IPP contracts can lack transparency and be prone to unacceptable practices. While IPP-based electricity supply can address The Gambia’s immediate electricity demands, it is not a sustainable solution. Over-reliance on powerships for electricity generation could be counterproductive. Insufficient investment and financial resources are the primary reasons the Gambian government continues to depend on external companies for electricity. These are short-term solutions that temporarily alleviate the situation but do not lead to energetic independence.

This dependency on foreign private companies for power generation creates imbalances that can lead to embezzlement and poor governance. Karpowership, for example, provides electricity to eight African countries, covering 100% of the market in Guinea-Bissau. In 2023, the company cut off electricity in Freetown (Sierra Leone) and Bissau (Guinea-Bissau) due to unpaid bills amounting to USD 40 million and USD 15 million, respectively. Consequently, these countries had to renegotiate contracts, resulting in reduced electricity at lower costs to mitigate risk (Akwagyiram, A., 2023).

What are the implications? We all contend with electricity bills. In Spain, for instance, if your bill is overdue by more than 20 days, your electricity is likely to be cut off. However, when entire countries face such a situation, the stakes are much higher. It should be deemed illegal to cut off electricity to an entire city simply because a government has failed to meet its payment obligations. There must be protective measures in place for citizens, alongside mechanisms such as collateral for the Independent Power Producer (IPP) in cases of non-payment. The rationale is clear: vital services such as hospitals, water treatment facilities, and other critical infrastructures are compromised, putting lives at risk. If a government is unable to pay, an alternative emergency fund should be available to compensate IPPs. Cutting off electricity to an entire city due to payment issues is not only unethical but also dangerous.

In my view, Karpowership’s decision to cut off electricity to those cities was misguided, but the ultimate responsibility lies with the government. As a journalist aptly states, “Karpowership is a necessary evil because of chronic underinvestment in energy infrastructure” (Akwagyiram, A., 2023).

Recent developments include the commissioning of a 23 MW solar plant capable of producing 23 megawatts of power at any given moment. This installation also features an 8 MWh battery storage system and is part of The Gambia’s Electricity Restoration and Modernization Project, which aims to achieve universal electricity access by 2025. Although modest in scale, this project will provide electricity to 18,000 households, significantly benefiting The Gambia. Moreover, the battery installation will stabilize the grid and mitigate the impact of fluctuations in solar power availability.

To put 23 MW of power into perspective, consider these examples of energy consumption (Nussey, B., 2019):

- Powering two 60-watt bulbs continuously for a year: 1.05 MWh.

- Supplying 1.2 months of electricity for an average American home: 1.08 MWh.

- Enabling approximately 5,800 km of travel with an electric car: 1.74 MWh.

- Powering two refrigerators for an entire year: 1.14 MWh.

Typically, data centers consume 2-3 MW of power, while hospitals and large food processing facilities may require several 2 MW+ backup power generators to maintain operations during outages. This investment will significantly enhance Gambian energy independence and increase the share of electricity generated from low-carbon sources.

The business potential in The Gambia’s solar power generation sector is substantial. With a minimum daily solar radiation of 4 kWh per square meter, the potential for energy production is noteworthy (U.S. Department of Commerce, n.d.). To illustrate, the average Spanish household consumes about 9 kWh per day. This means that just one square meter of solar photovoltaic (PV) panels, harnessing one hour of solar radiation at this rate, could generate enough electricity to power a Gambian home for an entire day (assuming full capacity).

The Gambia Electric Infrastructure

- Increase the number of main transformers: Currently, only 5 transformers at the 33/11 kV level are reported, along with 149 Compact Substation Systems and 90 Pad Mounted Transformers (PMT). Transformers are devices that regulate the voltage according to context needs. When electricity needs to be transmitted over long distances, voltage needs to be increased to prevent energy loss; whereas when electricity needs to be provided to households, voltage needs to be lowered to ensure safe use. Currently, transformers are likely to be overloaded given the scale of the network, leading to inefficiencies and potential outages.

- Reduce technical losses (currently reported at 18%): strengthen the current distribution network so new power generation can be sent safely and efficiently to the grid. Technical losses can significantly impact the overall efficiency and reliability of the electrical system, resulting in higher costs and reduced availability of power for end-users.

- Increase switchgear availability: There are 22 pieces of 33 kV switchgear which appears limited considering the size of the electrical network. Adequate switchgear is crucial for controlling and protecting the electrical grid and for minimizing downtime during faults. Switchgear ensures that circuits can be de-energized for maintenance and faults can be cleared without affecting the whole network.

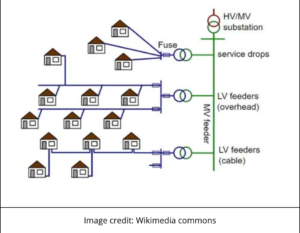

- Radial Feeder Systems: These are simple systems and cost-effective but are at risk of single points of failure. The Gambian government should consider installing network or loop systems if it wishes to provide households with higher quality electricity services. Loop systems create interconnections between feeders such that if there is one point of failure in one feeder, other feeders can supply electricity to the affected area. This redundancy is vital for enhancing the reliability and resilience of the power distribution network, ensuring continuous electricity supply even in the event of component failures.

Note: Radial systems are systems where electric generating stations are located at the center of consumers. Different feeders (i.e. conductors that carry the electricity) start from a substation/generating station and move the electricity towards a single direction.

Electricity Tariffs

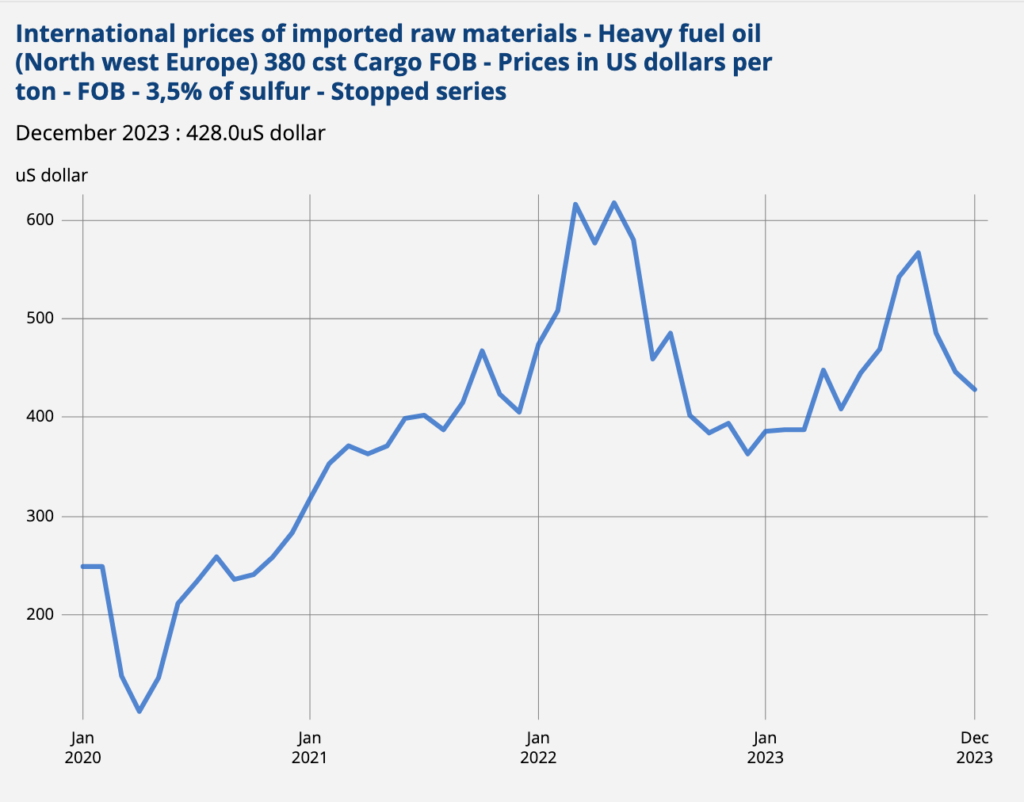

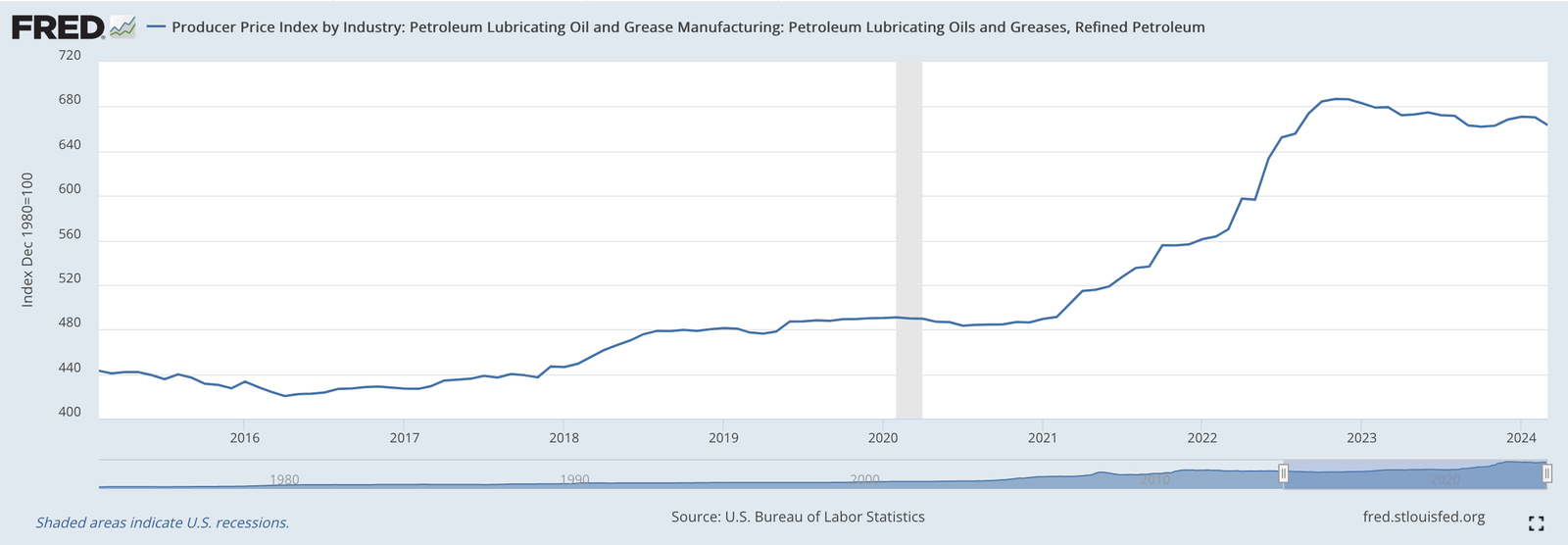

The Gambia’s electricity and energy costs are significantly influenced by imported materials, including fuel, lubricants, and spare parts. Using the Northwest Europe 380 cst Cargo FOB index as a proxy for imported fuel prices, we observe a substantial increase from around $220/MT in January 2020 to $500-$600/MT by 2023 (INSEE, 2023). This trend is supported by NAWEC’s Managing Director, Mr. Juwara, who cited these rising costs when announcing a notable tariff hike in March 2023: “The global landscape has changed dramatically. We’ve witnessed unprecedented increases in material costs, especially for NAWEC. Our primary cost drivers—fuel, lubricants, spare parts, and other materials—have all surged due to the impacts of COVID-19 and the Russia-Ukraine war. Despite our efforts to manage, it’s become untenable. To sustain our operations, we must face these harsh realities” (The Standard Newspaper, 2023). Additionally, the Petroleum Lubricating Oil index has risen sharply from 440 in 2016 to 680 in 2023 (Federal Reserve Bank of St. Louis, 2024).

The last tariff increase occurred in 2015. Mr. Juwara highlighted the challenges: “Most of our materials are imported, which complicates the situation. In 2015, Nawec purchased fuel at GMD 40 per liter, but it now costs almost GMD 78 per liter—a significant rise. Likewise, when the tariff was set in 2015, heavy fuel was USD 444 per metric ton, but today it exceeds USD 650.” Additionally, local currency depreciation worsens The Gambia’s trade deficit. The Gambian Dalasi was pegged at GMD 45 to the dollar but currently fluctuates between GMD 65 and GMD 67, making it difficult for Gambians to import essential raw materials (The Standard Newspaper, 2023).

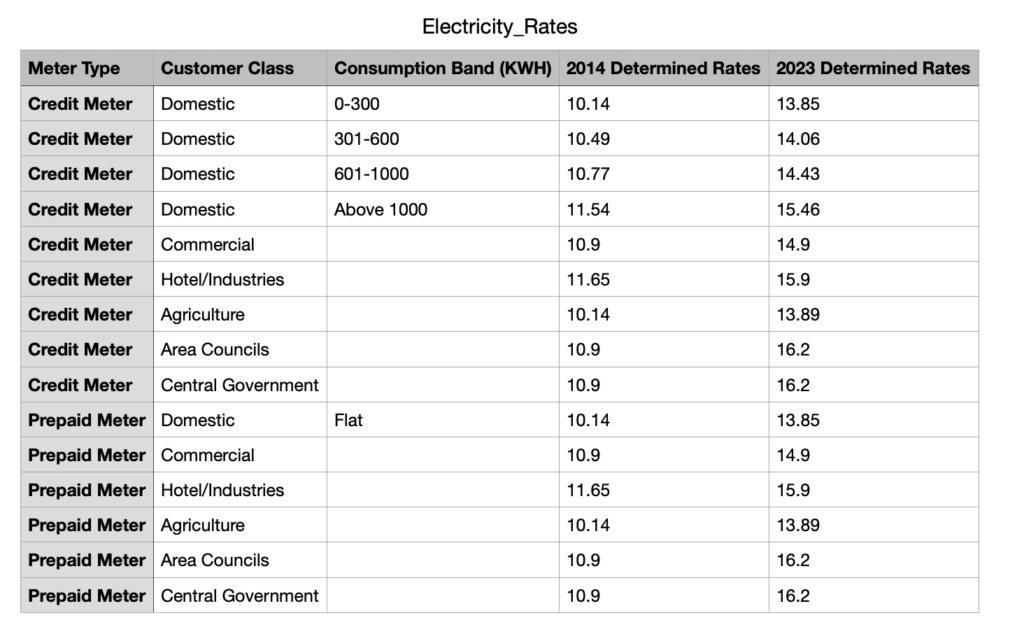

Consequently, tariffs have been increased. Below is a recreation of the table originally published by The Gambia Public Utilities Regulatory Authority (2023):

In The Gambia, the electricity tariff structure is organized by customer class, consumption levels (measured in kWh), and metering type—either prepaid or credit. The rates are structured progressively; as household consumption increases, so does the cost per kWh. This tiered pricing not only encourages energy conservation but also reflects NAWEC’s challenges in generating affordable energy. Most Gambian households fall into the 0-300 kWh consumption category, reflecting typical income and access limitations. Notably, tariffs have risen from GMD 10.14 to GMD 13.85 per kWh, an increase of 36.5%. There appears to be a clear link between the costs of heavy fuel oil and the pricing structure of electricity tariffs in The Gambia.

My friend E. buys electricity daily, spending 100 GMD each morning at a local shop to purchase a card that he then uses to activate his electricity meter with the company. As of 2024, 100 GMD of electricity equates to about 6.7 kWh. Consequently, his monthly electricity budget amounts to GMD 3,000, which is roughly USD 45. E. lives in a large household with 11 adults and 18 children; such extended families are common in Africa. Together, they use about 201 kWh of electricity per month. If we assume that children consume half as much electricity as adults, this works out to approximately 10 kWh per person each month. Applying the prepaid rate of GMD 13.85 from the 2023 tariff table to their usage, the cost would be 201 kWh x GMD 13.85 = GMD 2,783. Additionally, considering the electricity company’s service charge of 7 GMD per top-up, and with daily purchases, this adds up to an extra GMD 210 each month. Therefore, the total monthly cost effectively rounds up to GMD 2,993, which is virtually GMD 3,000 per month.

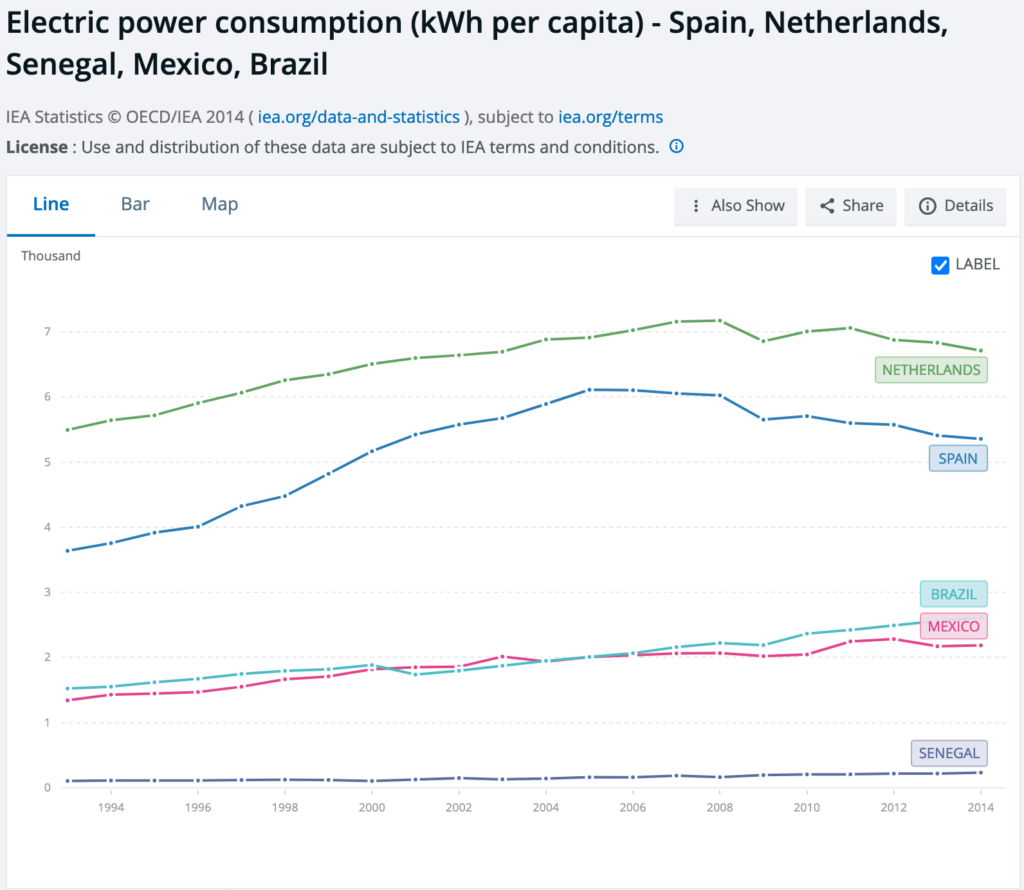

If you are not an energy engineer or policy maker, these numbers might not mean a lot to you. That’s why I want to bring other countries’ electric power consumption per capita in KWh as a way to really show the current situation in The Gambia. The metric electric power generation per capita in KWh is defined as the production of power plants and combined heat and power plants less transmission, distribution, and transformation losses and own use by heat and power plants, divided by midyear population (World Bank, n.d.).

High-income European economies such as Spain and The Netherlands have an average yearly energy consumption of around 6,500 KWh per person, which includes total energy production minus losses as defined above. This translates to approximately 541 KWh of energy consumption per person every month. By contrast, high-middle income economies in Latin America consume about 2,500 KWh per person annually, or around 208 KWh per month.

Let’s consider Senegal, the country geographically closest to The Gambia. Senegal’s annual energy consumption is about 233 KWh per person, which works out to roughly 19 KWh per person each month. This figure is still higher than the 10 KWh per person per month that I calculated earlier using my friend’s example from The Gambia.

To put this into perspective, an average U.S. household, with roughly 2.51 people, consumes about 900 KWh of energy monthly for household use alone. This breaks down to approximately 360 KWh per person, which is nearly 36 times the total electricity usage per person in The Gambia, covering all energy consumption, not just household use. This comparison highlights the significant disparity in energy consumption between the two regions.

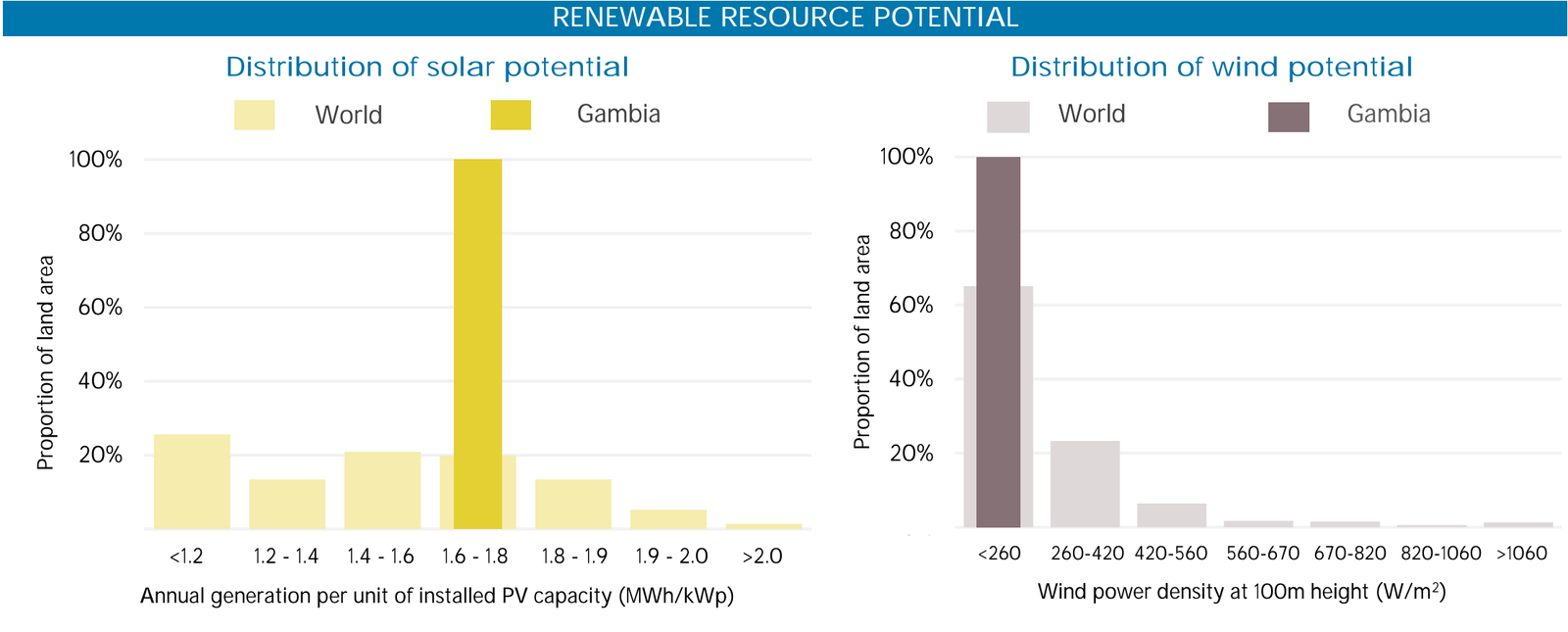

Can we do something about this disparity? Absolutely! I firmly believe that The Gambia has significant potential for solar power investment, and I will dedicate an entire section to exploring this opportunity. To give you a sneak peek: according to the International Renewable Energy Agency, the solar energy generation potential in The Gambia stands at around 1.6-1.8 MWh/KWp, indicating a favorable solar resource availability (International Renewable Energy Agency, n.d.).

Note: MWh is the generation capacity per unit of installed PV capacity. Being in the range 1.6 to 1.8 places The Gambia on the upper middle section of the countries with most efficient solar generation potential. On the other hand, wind potential is rather low for The Gambia. According to the Global Wind Atlas, the top 10% windiest areas in The Gambia generate around 226 M/m² in mean power density (compare this to The Netherlands which has around 1031 W/m²).

Investing in solar energy not only addresses the energy consumption gap but also promotes sustainable development and energy independence. By harnessing the abundant sunlight, The Gambia can drastically reduce its reliance on non-renewable energy sources and achieve a more stable and resilient energy future.

Bibliography

- African Development Bank. (n.d.). Multinational – Gambia River Basin Development Organization (OMVG) Energy Project Complementary Studies. Retrieved from https://projectsportal.afdb.org/dataportal/VProject/show/P-Z1-FAB-021

- Africa Energy Portal. (n.d.). Country profile: Gambia. Retrieved from https://africa-energy-portal.org/aep/country/gambia

- Nussey, B. (2019, June 23). What can you do with a megawatt-hour? Freeing Energy. Retrieved from https://www.freeingenergy.com/what-is-a-megawatt-hour-of-electricity-and-what-can-you-do-with-it/

- African Development Bank. (n.d.). OMVG Energy Project: Environmental and Social Impact Assessment Summary. Retrieved from https://www.afdb.org/fileadmin/uploads/afdb/Documents/Environmental-and-Social-Assessments/30744628-EN-OMVG-ENERGY-ESIA-SUMMARY.PDF

- Federal Reserve Bank of St. Louis. (n.d.). Producer Price Index by Industry: Petroleum Lubricating Oil and Grease Manufacturing: Petroleum Lubricating Oils and Greases, Refined Petroleum. Retrieved from https://fred.stlouisfed.org/series/PCU3241913241910

- Chint Global. (n.d.). Voltage transformer vs current transformer. Retrieved from https://chintglobal.com/blog/voltage-transformer-vs-current-transformer/

- European Investment Bank. (2024). Gambia: Strong international support for a new era of renewables with inauguration of historic 23 MWp solar plant. Retrieved from https://www.eib.org/en/press/all/2024-125-gambia-strong-international-support-for-a-new-era-of-renewables-with-inauguration-of-historic-23-mwp-solar-plant

- Ritchie, H., & Rosado, P. (2024, January). Electricity mix. Our World in Data. Retrieved from https://ourworldindata.org/electricity-mix

- International Renewable Energy Agency. (n.d.). Gambia – Africa renewable energy statistics profile. Retrieved from https://www.irena.org/-/media/Files/IRENA/Agency/Statistics/Statistical_Profiles/Africa/Gambia_Africa_RE_SP.pdf

- Statista. (2022). Electricity consumption per capita worldwide in 2022, by selected country (in kilowatt-hours). Retrieved from https://www.statista.com/statistics/383633/worldwide-consumption-of-electricity-by-country/

- Akwagyiram, A. (2023, November 7). Power ship company that cut electricity in African cities eyes expansion. Semafor. Retrieved from https://www.semafor.com/article/11/07/2023/karpowership-eyes-african-electricity-expansion

- Jackery. (n.d.). How many kWh does a house use? Retrieved from https://www.jackery.com/blogs/emergency/how-many-kwh-does-a-house-use

- Gauff Engineering. (2024, March 4). Second contract extension for the transnational energy project of the OMVG member states. Retrieved from https://www.gauff.net/en/news-aktuelles/alle-neuigkeiten/detail/second-contract-extension-for-the-transnational-energy-project-of-the-omvg-member-states.html

- Institut National de la Statistique et des Études Économiques (INSEE). (2022). [Statistical series on economic data]. Retrieved from https://www.insee.fr/en/statistiques/serie/010751334#Graphique

- Manneh, M. (2020). Challenges and Possible Solutions to Electricity Generation, Transmission, and Distribution in the Gambia. American International Journal of Business Management, 3(10), 87-93. Retrieved from https://www.aijbm.com/wp-content/uploads/2020/10/K3108793.pdf

- Gilpin, R. (2022, March 18). Africa’s just energy transition could boost health outcomes. Brookings Institution. Retrieved from https://www.brookings.edu/articles/africas-just-energy-transition-could-boost-health-outcomes/

- U.S. Department of Commerce. (n.d.). Gambia energy. Privacy Shield Framework. Retrieved from https://www.privacyshield.gov/ps/article?id=Gambia-Energy

- Bellini, E. (2023, February 7). Construction begins on 23 MW solar plant in Gambia. PV Magazine. Retrieved from https://www.pv-magazine.com/2023/02/07/construction-begins-on-23-mw-solar-plant-in-gambia/

- Jowett, P. (2024, March 29). Gambia commissions 23 MW solar plant. PV Magazine. Retrieved from https://www.pv-magazine.com/2024/03/29/gambia-commissions-23-mw-solar-plant/

- Energy Charter. (2021). Energy Risk Assessment ECOWAS-The Gambia. Retrieved from https://www.energycharter.org/fileadmin/DocumentsMedia/News/EIRA_Extended_Country_Profile_-_ECOWAS-The_Gambia.pdf

- Public Utilities Regulatory Authority. (2024). Electricity tariff. Retrieved from https://pura.gm/economic-regulations/tariff/electricity-tariff/

- The Standard Newspaper. (2023, March 28). NAWEC unveils new water and electricity prices. Retrieved from https://standard.gm/nawec-unveils-new-water-and-electricity-prices/

- World Bank. (n.d.). Metadata glossary – World Development Indicators: Electricity usage per capita (Series EG.USE.ELEC.KH.PC). Retrieved from https://databank.worldbank.org/metadataglossary/world-development-indicators/series/EG.USE.ELEC.KH.PC