Cocoa Fundamentals

Cocoa is a remarkable product with a rich history. Once cherished by pre-Hispanic cultures such as the Mayans and Aztecs for its nourishing properties, it has now become a cornerstone of global chocolate production. The cookie you enjoyed, the piece of chocolate that gave you a burst of energy, or the cake at your last birthday party—all these delights are made possible by cocoa. From just over 1.1 million metric tons produced in 1961, global cocoa production reached 5.6 million metric tons in 2019, reflecting an average annual growth rate of 2.66%.

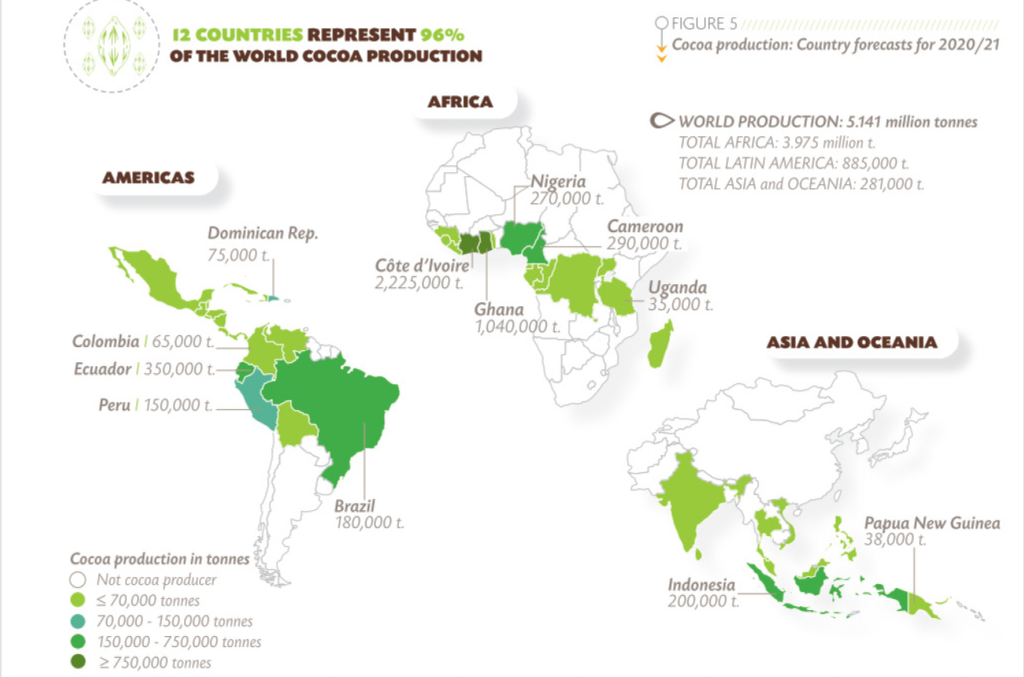

Today, approximately 70% of cocoa beans are sourced from West African countries, including Ivory Coast, Ghana, Nigeria, and Cameroon. Among these, Ivory Coast and Ghana are the largest producers, contributing over 50% of the world’s cocoa supply. During the 2022/23 crop year, Ivory Coast produced up to 2.1 million metric tons, while Ghana produced 850,000 metric tons (Statista, 2024).

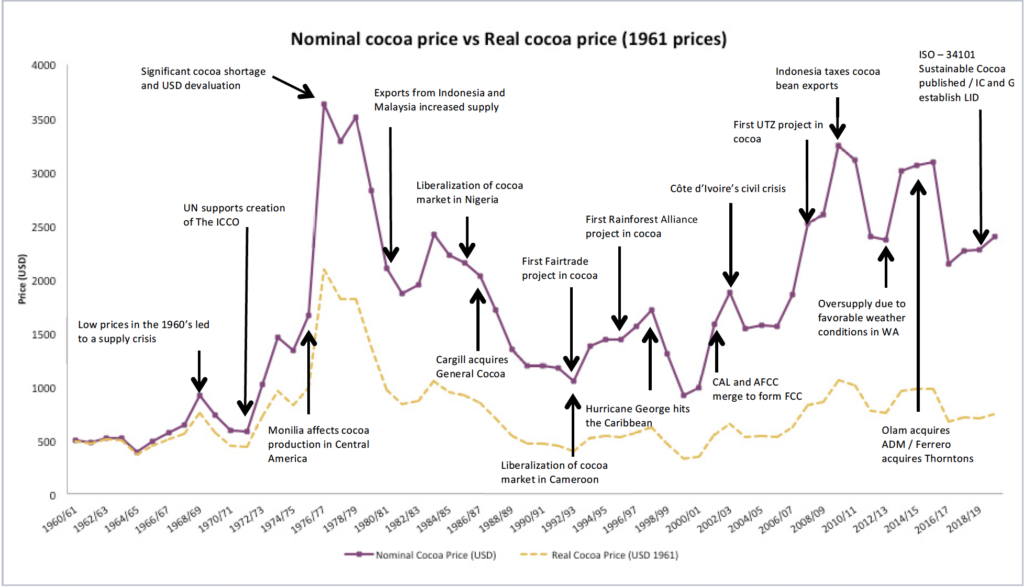

The price of cocoa beans is influenced by a variety of factors, including geopolitical events, agricultural conditions, and market dynamics. In the 1960s, the price of cocoa stood at 500 USD per metric ton (MT). Sixty years later, when adjusted for inflation, the real price remains almost the same. However, nominal price changes have shown significant volatility. For instance, during 1976-1978, the devaluation of the USD against major currencies caused cocoa prices to soar to nearly 3,700 USD/MT. Similarly, the civil war in Ivory Coast led to severe supply shortages, pushing prices from around 1,000 USD/MT to 1,800 USD/MT. Additionally, pests and diseases that damage crops can cause supply shortages, impacting international market prices and reducing stock-to-grindings ratios.

Export taxes imposed by producing countries can also affect international supply and prices. For example, in 2010, Indonesia’s export taxes incentivized processing companies to operate within the country where the raw material is sourced. A crucial aspect of the cocoa supply chain is that most value-added activities occur outside producing countries. Instead, these activities take place in importing countries like the Netherlands, Switzerland, and the United States, where the majority of consumers are located. This raises important questions about profit-sharing within the supply chain and the portion of the final retail value that farmers actually retain. The cocoa industry is characterized by high market concentration, particularly among traders and grinders. Companies such as Barry Callebaut, Cargill, Olam, Ecom, Sucden, Touton, CEMOI, Cocoanect, and Blommer (Fuji Oil) account for 60 to 80 percent of global cocoa processing. Furthermore, six major chocolate manufacturers—Mondelēz International, Nestlé, Mars, Hershey’s, Ferrero, and Lindt & Sprüngli—produce 40 percent of the world’s chocolate products (Ingram et al., 2018).

To truly understand cocoa, it’s essential to grasp the distinctions across its various product segments. The bulk mainstream cocoa segment refers to the standard, high-volume, and standard-quality cocoa that follows international market prices and competes for lower costs. This segment is primarily used to produce cocoa butter, derived from pressing cocoa beans and serving as the “fat” input for chocolate.

However, some consumers, particularly in developed regions such as Western Europe and the U.S., may demand bulk certified cocoa or premium segment cocoa. Bulk certified cocoa meets certain ESG standards set by certification bodies, which can allow it to be sold at a premium price, although this is not always guaranteed, and traceability can sometimes be limited.

The premium segment is further divided into premium certified, specialty, and ultra-premium categories. These three share characteristics such as low defects, fine aromas, and high-quality sourcing. The differences lie in their flavor profiles, stories of origin, and impurity rates. While premium certified cocoa may have small rates of impurities, specialty and ultra-premium segments are guaranteed to be impurity-free, with FOB pricing ranging from USD 3.5 per kg to USD 12 per kg.

Cocoa beans yield a variety of marketable products, each derived through different production processes and physical components of the bean. These products are regulated and labeled in the EU and U.S. with specific HS Codes and production content guidelines. By removing the cocoa bean shell, cleaning, drying, and cracking it, we obtain cocoa nibs, which can be used to make chocolate or sold separately as a healthy food product.

When cocoa beans are ground and melted, they produce a thick liquid called cocoa liquor, or cocoa paste, primarily used in chocolate production and semi-finished chocolate ingredients. To be labeled as cocoa liquor, it must contain between 50-60% cocoa butter. Additionally, cleaning, winnowing, roasting, and combining cocoa beans with over 20% cocoa butter and 9% water results in cocoa powder. Varying levels of cocoa butter, water, and sugar in the final mix create different types of cocoa powder, including fat-reduced and sweetened cocoa powder.

The star product made from cocoa is chocolate, which must contain more than 35% dry cocoa solids, over 18% cocoa butter, and at least 14% dry non-fat cocoa solids. By adding ingredients such as dehydrated milk or sugars, we can create new marketable products like couverture—a mix of cocoa liquor and butter, sugar, vanilla, or powdered milk—used for finished or specialty chocolate.

Overall, depending on the production process and ingredient mix, cocoa can be transformed into a wide array of products, each tailored to meet specific market demands.

Stay tuned for the next article which will be about an in-depth analysis of Global Market Trends!

Bibliography

- Gaia Cacao B.V. (2021). Global Cocoa Market Study. Retrieved from www.gaiacacao.com. Conducted by Gaia Cacao B.V., Nieuwezijds Voorburgwal 162, 1012 SJ Amsterdam, The Netherlands. Chamber of Commerce: 78049636.