Sustainable Finance

Progress is impossible without change, and those who cannot change their minds cannot change anything.

George Bernard Shaw

Sector Overview

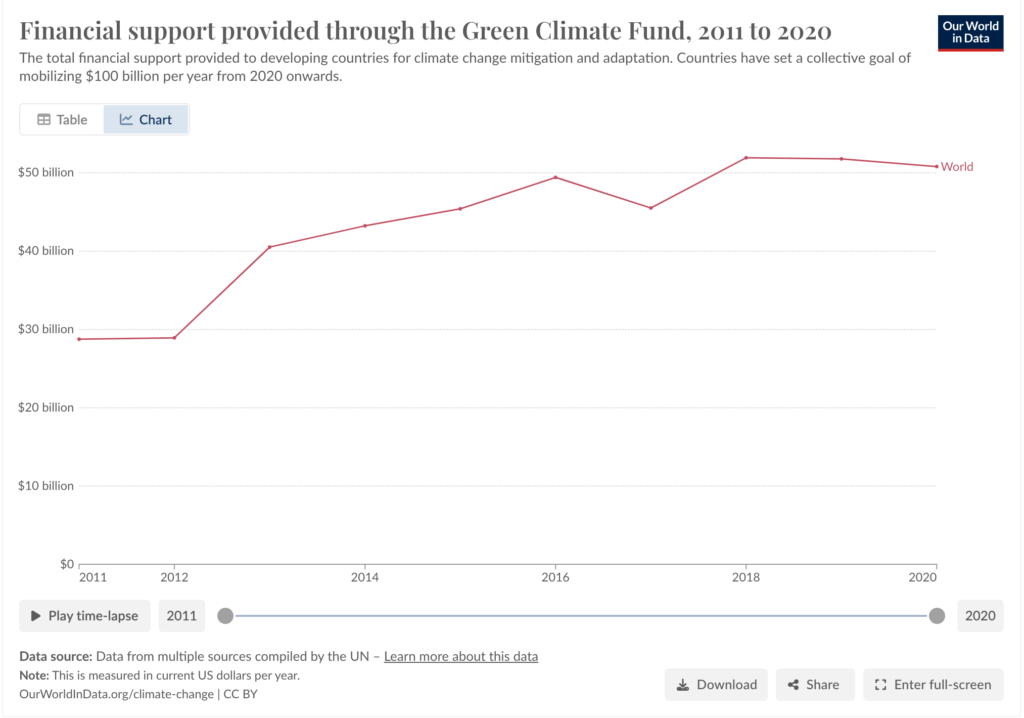

The green and sustainable finance sectors have grown rapidly, focusing mainly on "pure green" activities, representing less than 8% of the global economy. We aim to identify opportunities in broader investments, particularly in high-emission sectors struggling to transition to a low-carbon economy.

Transition Finance Framework

An effective transition finance framework aids sectors in achieving net-zero emissions, reducing risks like environmental impacts, energy access issues, and unemployment. We advise on designing these frameworks to support an orderly climate transition.

G20 Roadmap

The G20 Sustainable Finance Roadmap emphasizes incorporating transitional issues into finance methodologies. We align with these principles, ensuring your investments support a just climate transition and comply with global standards.

Five Pillars of Transition Finance

Our focus includes identifying transitional activities, ensuring transparent reporting, developing innovative financial instruments, designing supportive policies, and advising on mitigating social and economic impacts.

Implementing Principles

We review verifiable, transparent, and effective investments aligned with climate goals, mitigating social and economic impacts. We guide financial institutions and policymakers in leading the transition process through expert advice and insights.

Our Values & Research Commitment

Download to find out about our research methodology, topics of interest and core values.

Our Publications

Read our posts, research articles and learn about sustainable finance