A Market Dominated by the EU

When I worked in Cargill I learnt a simple but a humbling lesson: “Be where the market wants to be. And the market always wants food at home.”

Food is not going anywhere, and chocolate consumption neither. Unless something crazy happens overnight such as governments forbidding chocolate consumption due to some weird research finding going on, chocolate consumption will simply go on…

The biggest world market for chocolate is in Europe. Europeans love chocolate. Just look at the Swiss, the Dutch and Germans. I’m sure you will see some chocolate lying around their homes, maybe on their tables or inside the fridge, waiting to be shared at some special occasion. Most of coffee places also offer chocolate-based desserts, drinks and baking products. If you look at some of the largest chocolate producing companies, you will notice that most of them are headquartered in Switzerland or other central European countries.

Consumption is forecasted to grow by 7% YOY and the global cocoa beans market size is huge, valued at around USD 16 billion in 2023. By 2028, it is expected to reach USD 22 billion. What is even more shocking is that the moment you process those beans and convert it to what we know as chocolate, the market value increases a lot. Europe, for example, accounts for 58% of global cocoa imports but its chocolate market value reached EUR 42 billion: this is more than double than the entire global cocoa beans market.

If the cocoa beans market is expected to grow by 7% YOY, the chocolate market is expected to keep growing at an annual rate of 4.4% till 2030. And what’s one of the first rules that strategy consultants talk about when advising entrepreneurs when choosing your niche? Be in a growth market, not in a declining business. It’s typically easier to sell your product when you follow the market pull rather than trying to push a new product into unknown waters, without clear demand signs or overall consumer acceptance.

However, this is not it. There is an important trend that all of aspiring entrepreneurs that want to get into the cocoa and chocolate business need to be aware of.

A big shift has been taking place over the past years and it represents a market opportunity for improving farmers’ and local producers standards of living and position your company in a growing consumer segment.

Cocoa only grows in specific climates with a certain amount of rainfall, humidity and temperature. As a result, 99% of cocoa plantations grow in developing countries, specifically in West Africa. Ivory Coast and Ghana concentrate 60% of global cocoa production.

Since not so long ago, Europe and the U.S. processed most of the cocoa beans into industrial products including cocoa paste, butter, cocoa powder and chocolate.

The Netherlands has a long history of trading with different nations and realized that the business opportunity lied in importing raw materials from developing countries just to be processed thereafter and re-exported to their European neighbors at very high margins.

According to the Dutch Market Intelligence Report, The Netherlands is the world’s largest cocoa importer with 759,000 tonnes imported just in 2022 and the EU as a bloc produced “an estimated 3.6 million tonnes of final chocolate products in 2020”. This makes the EU as the largest chocolate producer and exporter.

High quality port infrastructure is a key market enabler that creates cost-reductions and increases market profitability. Large bulk containers of over 22,000 tonnes arrive daily to the ports of Amsterdam, Zaanstad and Antwerp in Belgium making it easy to maintain constant processing rates. The Dutch, contrary to the Belgians, process most of the cocoa exports in the country and only re-export around 25% of cocoa beans to European countries.

What happens to Switzerland then? Oh, the Swiss are also deeply involved in the cocoa business. In fact, Nestlé, Hershey and Barry Callebaut have trading and backend administrative desks in Switzerland, actively monitoring every step of the process.

If I had to list the key cocoa and chocolate players in Europe I’d recommend you to have a look at these companies:

- Barry Callebaut

- Cargill

- Cémoi

- Fuji Oil

- Natra

- Puratos

- Nestlé

- Mondelez

- Mars

- Hershey

- Lindt & Sprungli

These companies manage more than one million tons of cocoa yearly which might constitute 40-50% of global cocoa production during 2020-2021 period.

Production Shift Happening and Market Opportunity

After knowing a bit more about the market, I’d like to go back to this production shift happening. This is already impacting global players like Barry Callebaut and Cargill, and this is an untapped opportunity that you can tap into as a social entrepreneur, looking to make positive changes into people’s lives. Listen to me carefully.

Europe imports dropped by 319,000 tonnes between 2018-22. This means an average of 4.1% lower imports from Ivory Coast; a 6.7% decrease from Ghana; a 9.1% drop from Nigeria and a 4.8% drop from Cameroon. This market development is likely to keep growing the coming years. Why could that be?

Cocoa processing, also known as “grinding” is slowly shifting from consuming countries to producing countries. You could think of grinding as “the process of converting the cocoa nibs into a fine powder and then into smooth chocolate” (Cocoa Runners).

In fact, CBI mentions that global grinding increased by 4% between 2018-23. This trend is not new at all; Ivory Coast surpassed 10 years ago the Netherlands as the world’s largest cocoa grinder in the world. This means that production is increasing but the place where value-adding activities are taking place is changing.

West African producing countries are producing semi-finished commodities that include paste, butter and powder and exporting them to the EU and the U.S.

West African nations have plans to increasing local processing to at least 50% through favorable tax benefits schemes and other financial incentives that keep attracting multinationals. And that’s where you step in.

Barry Callebout is processing 200,000 tonnes annually in Ivory Coast and Cargill completed an expansion of its processing site with a capacity of 170,000 tonnes. Ofi, a food ingredients supplier and Guang Chong, a Malaysian-headquartered company, opened a new facility in 2022.

This was just 3 years ago. This is of course helping the country as a whole generate more tax revenues from those products exports and a workforce upskilling from only producer to also processing and manufacturing. However, most of the benefits are still unevenly distributed and this is where new, innovative business model and ambitious entrepreneurs step in.

For now, keep thinking about it and I promise I’ll come back with some ideas on how you can create your own distributions channels while also benefitting the farmers. It’s called: business with purpose.

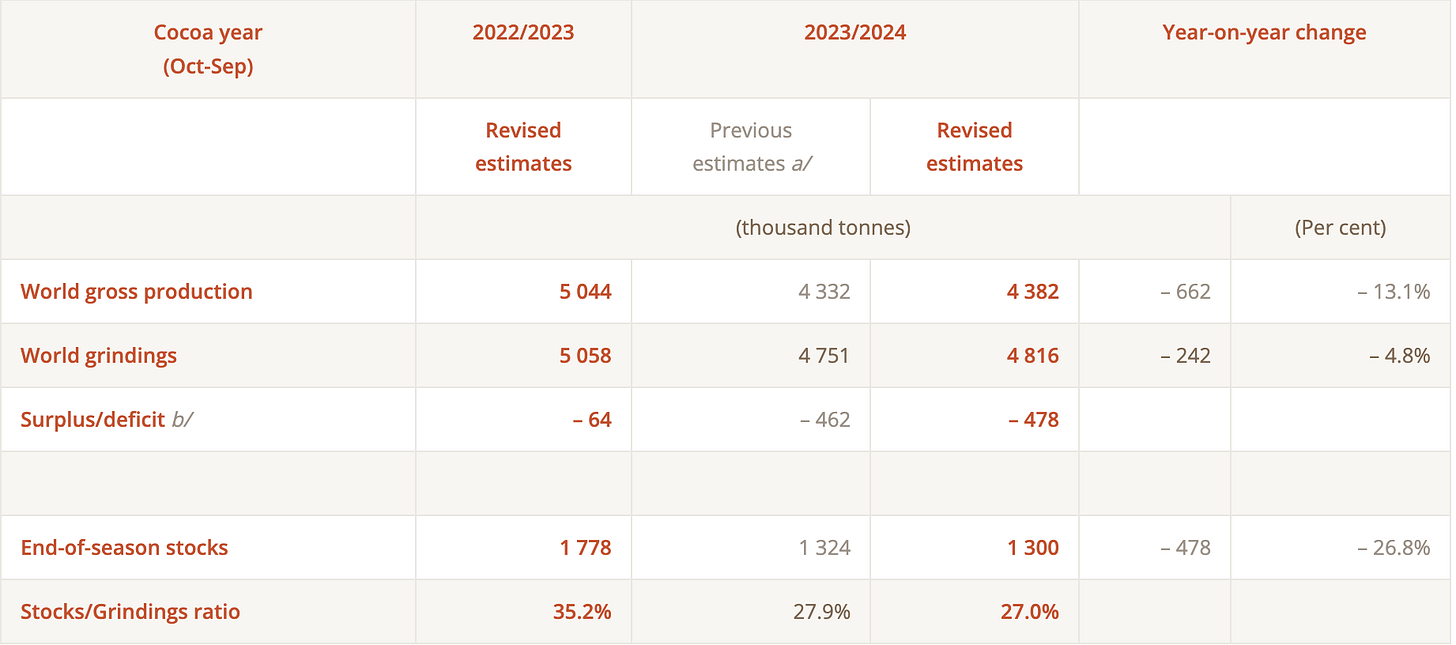

I leave you this nice chart where you can see the amount of cocoa production, grinding and what were the surplus deficits. Luckily stocks are high enough to keep prices more or less stable. This is, at a high level, how you can look at cocoa market economics.

If you require any market intelligence, research or other type of service. Please consult my website at Ecowater-Economics.com or send me a LinkedIn request.

This article could not have been made without the support of the following sources:

- International Cocoa Organization. (2024, November 29). November 2024 Quarterly Bulletin of Cocoa Statistics. Abidjan. https://www.icco.org/november-2024-quarterly-bulletin-of-cocoa-statistics/

- Ministry of Foreign Affairs of the Netherlands (CBI). (2024, May 23). What is the demand for cocoa on the European market? https://www.cbi.eu/market-information/cocoa/what-demand

- Cocoa Runners. (n.d.). Grinding and Conching. Retrieved March 23, 2025, from https://cocoarunners.com/chocopedia/grinding-and-conching/