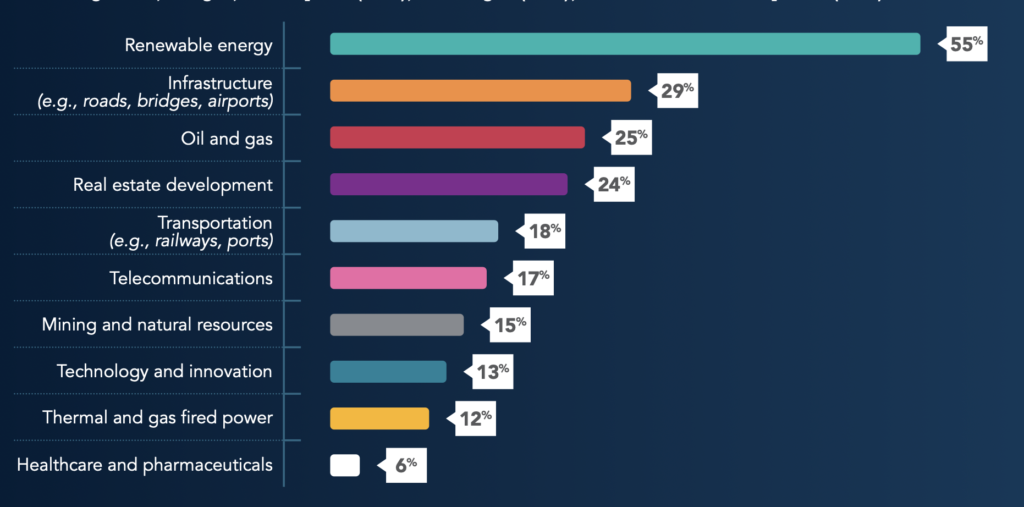

With the growth and advent of renewable energies, project finance (PF) is also becoming increasingly popular to finance these deals. In fact, around 55% of project finance deals come from renewable energies, followed by infrastructure, oil and gas (O&G) and real estate development. CSC published, in their 2024 Project Finance, interesting figures about the type of professionals that work in PF including legal and financial advisors, sponsors, underwriters, investors and lenders. But, what’s the actual difference between corporate finance and project finance?

The first thing you need to know is that when a company issues debt (i.e. borrows money), not all debt has the same priority. Imagine that right now you owe $100 to your best friend, $100 to your phone company and $100 to your mortgage bank. Who are you going to pay first if you only have $200 now? Most people would say your bank and your phone company (Sorry, now you are not a good friend!). But why? Because you have a legal obligation to pay to these institutions first and maybe with your friend, there will be a bit more leniency to pay him in a week instead of today.

When companies issue debt, every person who buys their debt (i.e. bondholders) have a different type of priority. Senior debt is always going to be prioritized over other type of bondholders if the company goes bankrupt. This is called “seniority of claims”. The more senior your debt is, the better for you! However, as in life, finance returns will also be lower if you are not willing to take a risk. Therefore, senior lenders often require a lower interest rate than, let’s say, junior bondholders or even mezzanine debt.

Junior and mezzanine bondholders are effectively subordinated debt because they will only receive their money after senior bondholders have been completely serviced. In mezzanine debt, this goes a step further because if the company is unable to repay this portion of the debt, bondholders may hold warrants to convert their debt into equity instruments, which would give them ownership of the actual company!

Mezzanine financing has the lowest priority claims across bondholders but it is still senior to pure equity. These investors have a higher risk profile and expect returns between 12% to 20% per year, sometimes even as high as 30%.

The benefit of mezzanine financing is that debt is cheaper than equity: you are not giving up a stake or ownership of your project to anyone else. Equity does not get diluted. That means, if you own 100%, then you can take home 100% of the returns, right? If you start having many different owners, you will have to split the earnings as well.

Now that we understand the priority of claims, we are ready to understand the real difference between corporate financing and project finance.

When a company issues debt from their own books (i.e. their balance sheet and P&L), this increases leverage and bondholders are entitled to the company’s assets in case of default or non-payment. On the other hand, project finance creates a separate legal entity, known as special purpose vehicle (SPV), to finance a certain large scale infra project. If the project does not go well, lenders have limited recourse and cannot take the sponsors’ assets just like that.

The problem with project finance is that costs to set up the legal structure are quite high. They can reach up to 5-10% of the total investment cost. But why? We will talk later on about the actors, companies and requirements of PF in detail, but just to give a glance of its complexity, please see the bullets below:

- Lead Financial Arrangers and Underwriters

In large scale projects, such as the N4 Toll Road that spans over two African countries including South Africa and Mozambique, Future Bank Corporate Merchant Bank and Banco Comercial had the responsibility to:

- Structure the entire financial package (deciding levels of debt, covenants, term sheet contracts, equity etc.)

- Coordinate between all parties including large legal teams involved in managing international agreements and revenue-sharing arrangements.

- Handle all of the technical and know-how documentation to sustain the financing of the project, including future cashflow projections with other banks and risk mitigation strategies to protect from default.

- Sponsors

Bouygues, Basil Read and Stocks & Stocks were the companies who invested their own money (known as “equity injection”) into the deal (Introductory Manual on Project Finance for Managers, 2001). Typically sponsors have some degree of technical competency with the project that they want to build. For example, for the N4 Toll Road, Basil Read is a South African construction company that had previous experience in such constructions.

Additionally, sponsors can also become the operators once the road is built, which will lead them to having additional revenues/costs over a longer time span.

- Government Stakeholders

These are largely involved in large scale infra projects as it affects the well-being of the people that live in the areas; and might support the project by becoming coordinators and debt guarantors if the bondholders do not receive their promised payments. They also ensure that projects are met within deadlines and comply with all legal and technical standards, such as materials used for building a bridge or a tunnel.

In this example, the South African and Mozambique governments were involved.

There are many other participants that play a role in these PF transactions. These include, but not limited to, development banks such as the European Investment Bank (EIB) or Chinese Development Bank as well as institutional investors, insurance companies, commercial banks, SPVs, technical maintenance and operating companies.

Higher PF costs are not only due to the complexity of the deals but also because lenders have no or limited recourse. This automatically demands a higher rate of return.

To conclude, corporate financing is like getting a mortgage. You add it to your own debt and you put your home as collateral in case of default. Project finance is more like owning and operating an apartment complex where the lenders can only be repaid from the rental income that the building generates. If the project fails, they can take over the apartment complex, but they can’t go after your other assets or personal wealth. The lenders are primarily betting on the project’s ability to generate stable cash flows from its tenants.

When should you do each? When you have a project that is closely related to your business, does not add any strain or high leverage (thereby not increasing your cost of capital), it is a good idea to use corporate financing.

When the project is very large, complex and has a lot of technical details, I’d suggest taking into account the possibility of project finance. Especially, if you are an engineer that wants to play a role in finance.

Other more intangible factors such as historical successes, contractual relationships and high ethical standards also play an important role in creating successful PF projects. Do not undermine them!

Do you want to learn project or corporate finance? Book a 30-min free session with me to establish your learning objectives and get your dream job! I also provide free 30 min advisory and consultancy services.